Lieutenant General His Highness Sheikh Saif binZayed Al Nahyan, Deputy Prime Minister and Minister of Interior, delivered a keynote addresstitled "Humankind: The Core of Civilisation and Pioneer of the Future." He emphasized theUAE's

UAE, Dubai, Jabal Ali First, The Offices At Ibn Battuta Gate, Office 1001-162 info@ram-energy.net

News

- You Here!

- Home Category: News

(WO) – Southern ITS International, Inc. announced that its subsidiary, Pure Oil & Gas, Inc., is providing a Progress Report on its first well drilled in Eastland County, Texas. Jeremy Larsen, President of

(WO) – QatarEnergy signed definitive agreements with China National Petroleum Corporation (CNPC), covering the long-term supply of LNG to China and partnership in the North Field East LNG expansion project (NFE). The two

India’s crude oil imports fell slightly in April from a month earlier and refinery intake dipped month-on-month, according to data from the Joint Organizations Data Initiative (JODI), but on the following month of

Colorado-based Civitas Resources plans to boost its presence in the Permian with a $5-billion acquisition, Reuters has reported, citing unnamed sources. The targets of the acquisition include Hibernia Resources the majority of assets owned

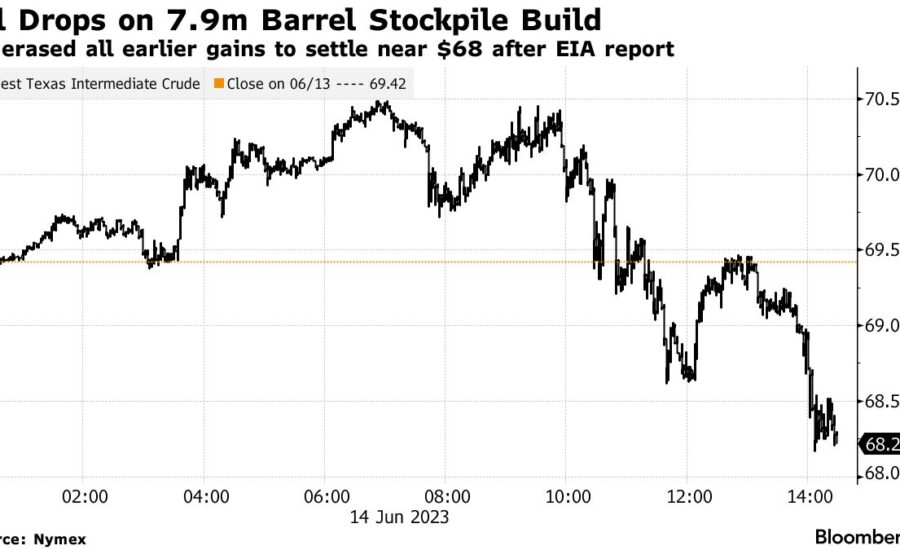

Oil dropped as a massive increase in US crude stockpiles and the Federal Reserve’s hints that rate hikes will continue crushed the risk-on sentiment that prevailed earlier in the day. West Texas Intermediate

Oil traders are starting to ignore the most important person in the market. It could prove a risky gambit. A week ago, Saudi Arabian Energy Minister Prince Abdulaziz bin Salman pledged to unilaterally

US agribusiness Bunge Ltd. agreed to buy Glencore Plc-backed Viterra for $8.2 billion in stock and cash, creating a trading giant capable of competing with the world’s biggest agricultural commodity traders. Viterra shareholders will eventually own

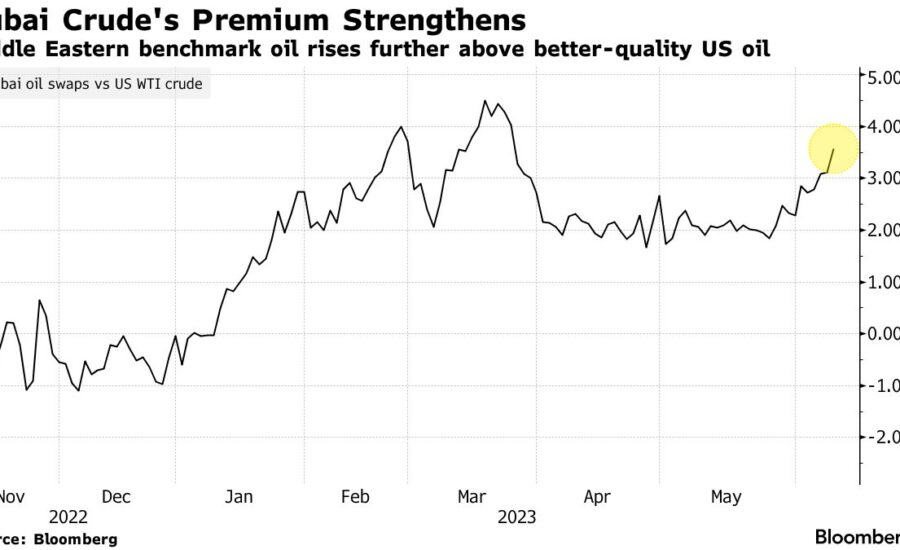

A surge in activity in a key Middle Eastern oil trading window is affecting the cost of the region’s crude against global benchmarks, a factor that’s impacting the viability of long-haul shipments from

Some of the biggest names in the global oil market are piling in on opposite sides of a normally sedate Middle East crude-trading window, making it harder to assess the impact of deep

- 1

- 2